Risk management is a pro-active, real-time solution that provides advanced analytics and quantification of entity obligations based on the widely accepted models CME-SPAN®, Value at Risk (VaR) and thumb rule. The system has risk management tools which assists an exchange to effectively identify and mitigate risks associated with traders’ portfolios.

Risk management is a pro-active, real-time solution that provides advanced analytics and quantification of entity obligations based on the widely accepted models CME-SPAN®, Value at Risk (VaR) and thumb rule. The system has risk management tools which assists an exchange to effectively identify and mitigate risks associated with traders’ portfolios.

Highlights

Risk Management solutions for Multi-Asset and Multi-Currency Products

Margin computation based on thumb rule, VaR and CME-SPAN®

Mark-to-Market (MTM) based Alerts and Margin based Alerts

Risk Management at Account Type level

Real-time risk analysis and management with minimal user intervention

Integration with multiple systems for real-time dissemination of risk details

Margin benefit to members for mitigating the risk based on inter-commodity or multi-tier positions

Ability to perform “What if” analysis by changing possible factors determining the risk

Extensive value added reports to provide data to third party reporting software (Data Warehouse)

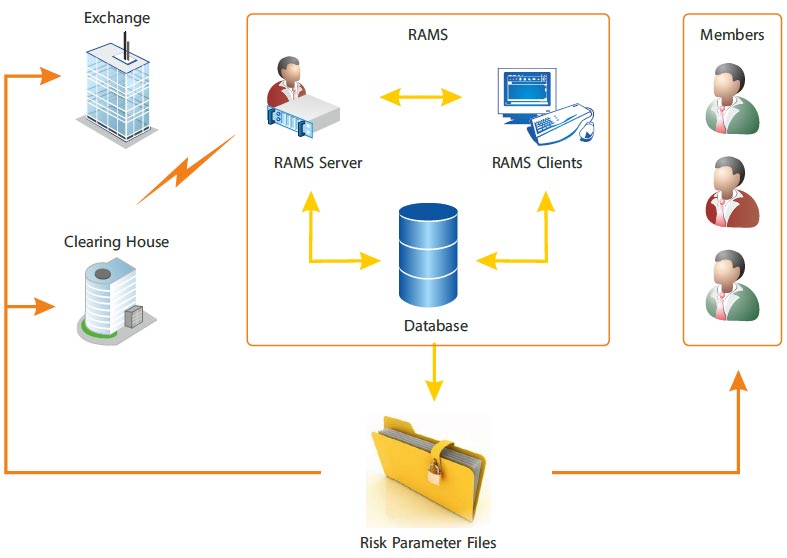

Architecture